Switching jobs? Here are Top 4 options to consider for your 401(k) plan

Okay so you are leaving your employer? But wondering what to do with your existing 401(k) plan, then here are Top 4 options to choose from.

Option 1: Rolling it Over to new 401(k) account

Option 2: Rolling it Over to Individual Retirement Account

Option 3: Leave it with your former employer

Option 4: Cashing Out

If you have contributed-

- Less than $1000 : Former employer might cut you the check for the contributed amount (which you can deposit in a new 401(k) plan or IRA)

- $1000 – $5000: Former employer might do an involuntary cash out i.e. They might move your money into an IRA

- More than $5000: You can leave the money in the former 401(k) plan

(Please note that these are IRS guidelines, your employer might take your consent for doing so but it is not mandatory to take approval from your end.)

Before deciding what to do with an existing 401(k) plan make sure to go through the pros and cons of all the options available.

Option 1: Rolling it Over to new 401(k) account

You can move your old 401(k) balance to a new 401(k) account if your new employer allows for it, this might be a good choice if your new 401(k) has low fees and diversified investment options. Rolling over helps you to maintain the account’s tax-deferred status and will help you to avoid taxes.

You can do a direct rollover (i.e. the money will move from your old plan to your new 401k account) or you can write a check for your old 401k balance and deposit with the new employer. Please ensure that you transfer it timely to the new plan, otherwise you may face tax consequences.

There is nothing wrong with having multiple 401k accounts. However, it increases administrative work. You need to manage various tax documents, remember multiple logins, update beneficiary details, and email IDs for various 401k accounts..

If you have all retirement investments in one 401k account then you can easily track & manage the money by avoiding any duplicate investments. It would also help your advisor to ensure whether you have a diversified portfolio or not. If your plan contains shares of the old company’s stock then consult a tax pro on what to do with those assets, as there is a chance that you could give up the tax benefits if you move them.

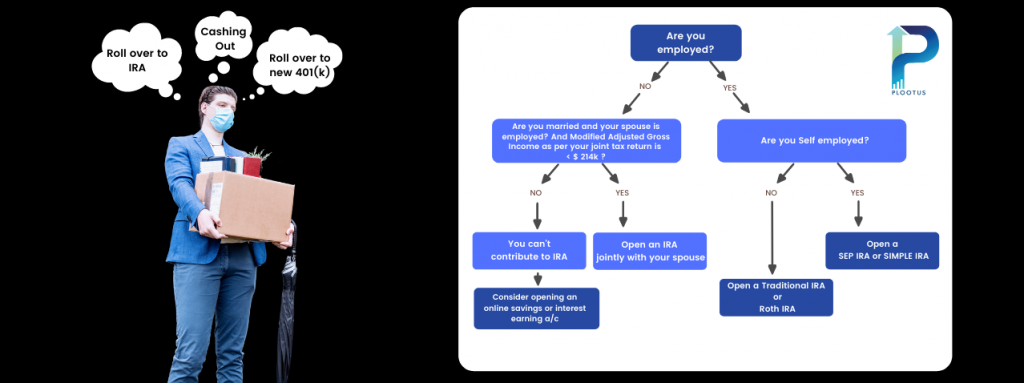

Option 2: Rolling it Over to Individual Retirement Account (IRA)

If you have switched your job and your new employer does not offer a 401(k) plan, 403 (b), 457 or other retirement plans then you can rollover your old 401(k) savings into a new or existing IRA. You will have various investment options to choose from. IRA will offer you more flexibility and you can invest as you wish but make sure you have enough time and energy to do so otherwise you can pay a financial advisor to manage your IRA. When you are rolling over, make it “direct rollover” as you would do while moving money from an old to a new 401(k) plan.

To know more about IRA check Choosing the best IRA for yourself

Option 3: Leave it with your former employer

If your account’s worth is at least $5000 then your former employer might allow you to keep 401(k) in the old plan for an indefinite time but you won’t be able to make any contributions to it. This makes sense only if you are satisfied with the management of plan & investment choices offered by your previous employer, but if you are someone who switches jobs frequently then you will have a chain of 401(k) plans, and there is a chance that you may forget about a few of them.

If your former plan provides perks like free research reports, top-notch & low cost investment options then consider going with this option.

Option 4: Cashing Out

Cashing out might be tempting but it is a bad idea unless you are facing extreme financial problems like bankruptcy or losing your property and you need urgent cash. Cashing out can affect your financial security because, on one hand, you have to pay taxes/penalties, on the other hand, lose investment growth potential. The penalty and taxes cause you to lose around 40% ( approx 24% as Federal tax, 4-6% as State Tax,10% as Penalty) of your contributions.

Do remember your retirement savings are diminishing away. So cashing out should be your last option.

You should always compare the 401(k) plans of your former and new employer. If an employer is providing a variety of Investment options by charging lower fees then go for it. Plootus can help you look up your employer’s plan & you can get absolutely FREE advice to pick the right investment.

Until next time!

Sheikh Nazrana, Sunil Gangwani

Plootus